“Buy land – they’re not making it anymore!” is a well-known, often-cited quote from Mark Twain, and one regularly present in the real estate pitch palette. In Mauritius, with a land surface area of only 2,040 km², paired with a transgenerational culture of real-estate investing, land has been particularly of high priority in a typical investment portfolio.

This said, roughly a hundred years after Twain, Peter St. Onge (from Profits of Chaos) writes, “As counterintuitive as it may seem, we make land all the time. It just doesn’t look like land.” To be fair, St. Onge has had the benefits of a century’s worth of advancement in economics. Surely, as he rightly puts it, land’s value comes from its economic usefulness, and is affected by factors such as access, regulations, and neighborhood, and not just supply.

When it comes to residential property, these qualitative factors are clear determinants of value. Along this line of thinking, we decided to analyze certain property value indicators in three regions of the island where we have invested in real estate development – Moka, Black River, and Savanne (Bel Ombre).

Moka:

All official residential towns in Mauritius are in the district of Plaines Wilhems, which contains 40% of the national population – historically being a question of accessibility, topography, and climate. A quick satellite view is enough to see the concentration. However, a common tendency for urban areas is to get more congested with time, and as a result, more expensive. In the absence of maintenance and upgrade, they also depreciate in living-quality.

Moka district, bordering Plaines Wilhems along its North-East side, has for long been an interesting, if not ideal alternative – part of the Central Plateau, temperate climate, proximity. With the development of Moka Smart City, new access roads, the largest shopping mall in Mauritius, and the relocation of several businesses, the effect on property prices has been clear.

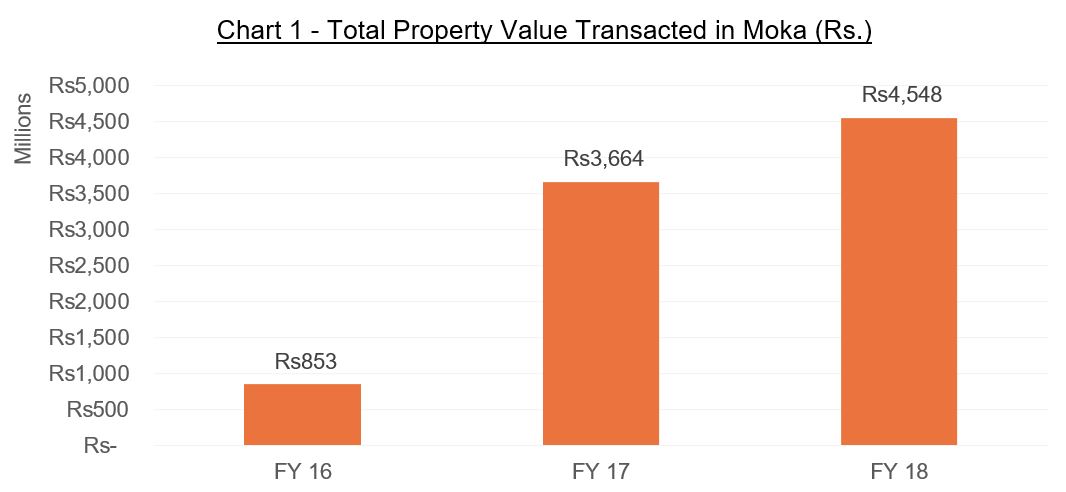

As per information extracted from the registrar, the total value transacted over the 3-financial-year (FY) period ending June 2016-2018 was Rs. 9.1 billion (~US$ 259 million), with a notable 24.1% increase in 2018 to Rs. 4.5 billion ($US 129.9 million) – Chart 1.

We also observed that the average value of transaction per unit in FY 2018 was Rs. 26.6 million ($US 759.9 thousand), a 19.1% increase from FY 2017, which in turn had a little more than doubled from the year before. In addition, a look at residential land rates is also revealing. The price per arpent (1 arpent = 4,221 m²) of residential land in Moka, as per last available data in 2019, was Rs. 29.7 million/arpent, an increase of 10% over the past 3 years.

To measure real estate development activity, we also had a look at the number projects undertaken over the past 3 years. This indicator gave us an average of 8 projects over this period, which in fact coincides with the principle behind the Moka Smart City – high planning for high quality living, integrating residential, business, and leisure spaces.

Black River:

This district is defined by scenic landscapes, mountains rising from the coastline, along which is traced the longest beach in Mauritius, beautiful lagoons, a mecca for nautical activities. Further down the seaboard to the extreme southwestern tip, stands a monolith at 556 m above sea level – Le Morne Brabant, a UNESCO World Heritage site, which also overlooks a legendary kite surfing spot. Also housed within Black River is a large part of the 6,574 hectares of forests making up the Black River Gorges National Park with its 60 km of trails. The main road A3 which converts to B9 and becomes a popular scenic route along the South coast, can be accessed at two points from the Center of the island. The region has also developed rapidly over the past recent years, now accommodating modern facilities, restaurants, bars, shopping centres, and essential services such as healthcare. However, it is reassuring to note that the rural cache has been mostly preserved.

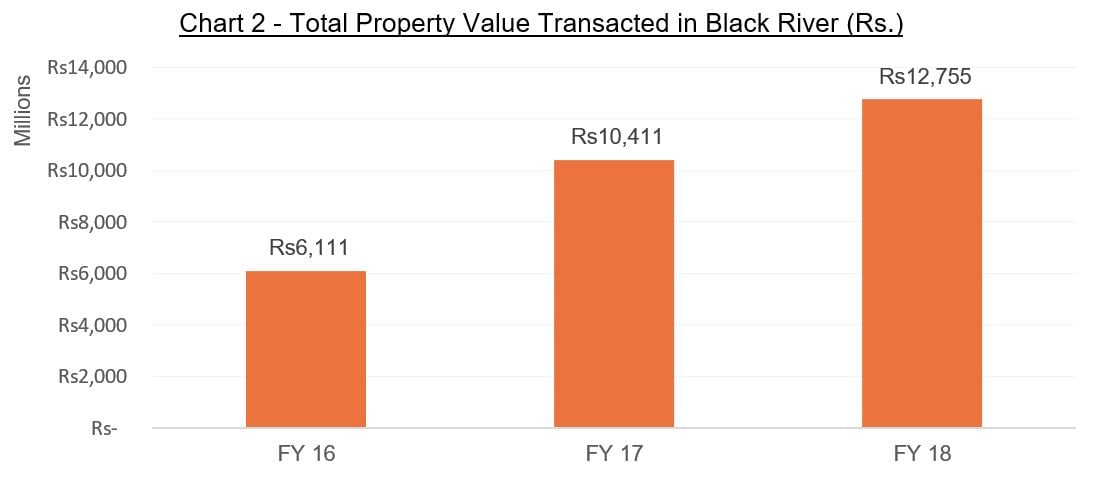

The total value transacted over the 3-financial-year (FY) period ending June 2016-2018 in Black River was recorded at Rs. 29.3 billion (~US$ 836.5 million). The FY 2018 figure was Rs. 12.8 billion (~US$ 364.4 million), a 22.5% increase from the previous year – Chart 2.

Further information extracted revealed that the average value per transaction in Black River was Rs. 18.5 million (~US$ 527.4 thousand) in 2018. If this figure is lower than that recorded in Moka, we must also consider that total units transacted in 2018 in Black River were by far higher at 691 (as opposed to 171 in Moka). In development activity metrics, we recorded 146 projects in 2018 (up from 105 in 2017, and 35 in 2016).

Bel Ombre:

Property activity here is very much a function of select taste – for culture, for nature, for golf, or all three. In other words, it is niche. For this reason, it has imparted with the ideal setting for luxury property development.

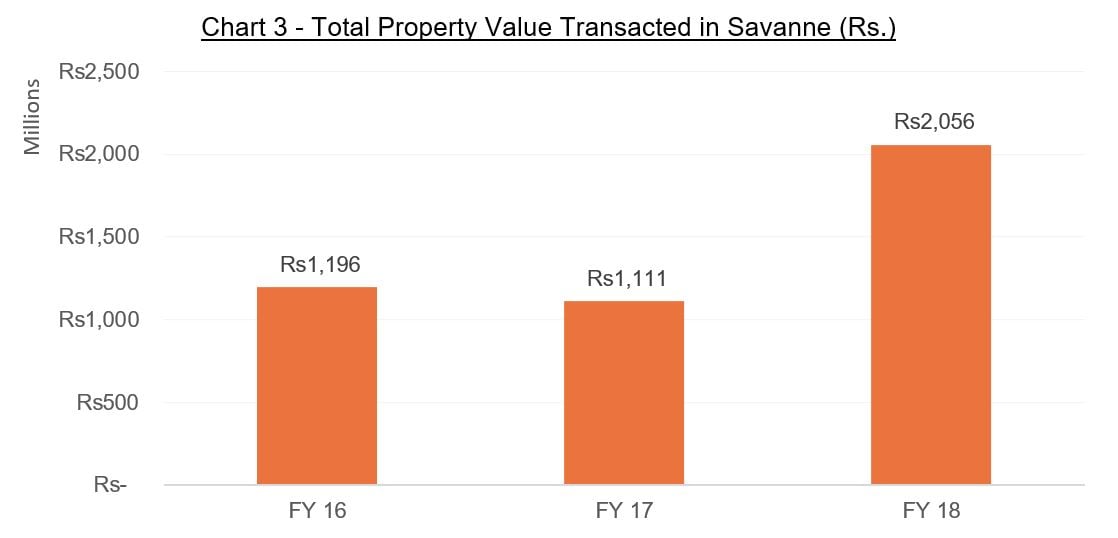

We have focused our study in the area of Bel Ombre, and we have found that the total value transacted over the 3-financial-year (FY) period ending June 2016-2018 was Rs. 2.1 billion (~US$ 58.7 million), a sharp increase of 85% over the previous year – Chart 3.

Even though we applied the same metrics as for the previous regions, we found that the interpretation of them could not be directly applied. For example, we observed lesser units having been sold in FY 2018 (88) when compared to FY 2017 (116) even though the total property value transacted significantly increased. There have also been only 2 projects undertaken in 2018, and equivalently in 2017. This can be explained by the high-end nature of property development in this region – quality over quantity.

Buying land in Mauritius is a smart investing, and it is even smarter to buy land in regions which have been well planned!